Upgrading to a digital-enabled core banking system is inevitable, even if some banks try to put it off for as long as possible. And who can blame them, when this is likely to be one of the most expensive, complex and risky IT endeavours that a bank has to undertake.

Similar to other industries, banks must come to terms with customer trends, preferences and expectations that require, at their core, automation and digitization. But unlike other industries, banks must also meet financial regulators’ elevated standards for reliability and data security.

This challenging combo has given rise to three often-cited strategies for converting from legacy to modern core banking systems, ie plunge, phased, or pilot.

- Plunge is a one-time big bang cutover that is perhaps the cheapest but also riskiest approach.

- Phased is based on a gradual and module-based roll-out that is less risky but ultimately most disruptive as the process can drag out over years or even decades.

- Pilot adoption trials a new system within an independent and smaller, but similar business. This contains the implementation risk but applicability can be limited.

Parallel adoption is not always possible

A fourth strategy, parallel adoption, is often excluded because of common data and proprietary constraints.

- Parallel adoption is the process of running both old and new systems simultaneously until such time that the new system is deemed ready to take over from the old.

While this is the lowest risk of the conversion strategies listed above, and ideal for mission critical functions such as core banking, it often not implementable. This is because legacy and new systems generally do not share the same data structures, or legacy systems prevent sharing of their database. The infrastructure and resource costs of maintaining two systems can also be high.

A bridge from old to new

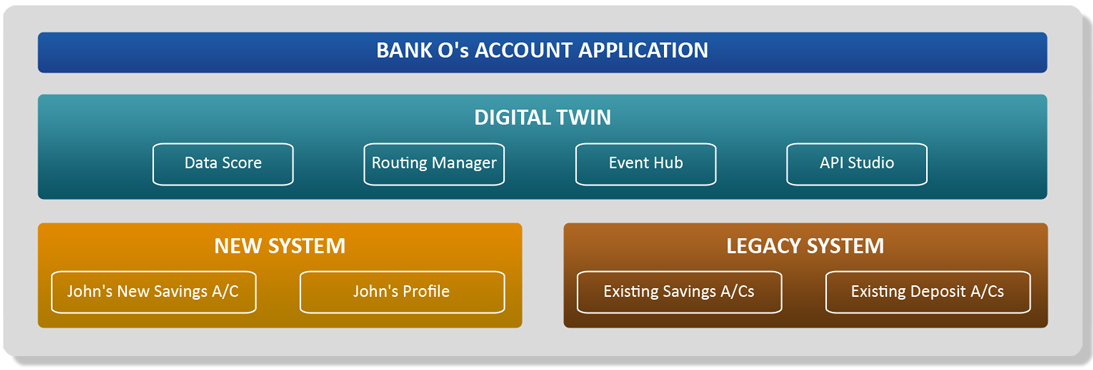

An elegant solution to this problem is to deploy a digital twin. The twin enables banks to run both old and new systems but for different sets of customers or products. Data integrity is maintained by enabling transactions to draw on the same data store that is integrated with both the old and new systems, and therefore functions as a single source of truth.

Take John for example. He is not yet a Bank O customer, but wishes to start a savings account. Bank O is in the midst of transitioning from a legacy to a new-age, digital-ready core banking system. Because John is a new-to-bank (NTB) customer, Bank O stores his profile data and opens his new savings account on the new system.

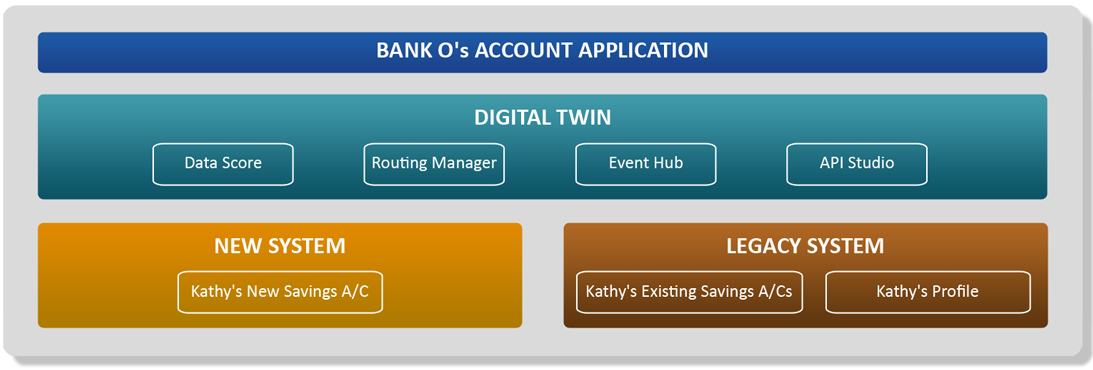

Kathy on the other hand, is an existing deposit customer with Bank O. She now wishes to apply for a savings account. By deploying a digital twin and routing mechanism, Bank O is able to use the data captured on the legacy system in order to open Kathy’s new savings account on its new system.

Many Advantages

In this way, Bank O is able to retain its legacy system while test driving its new system. Similar to a parallel adoption approach, the legacy system can act either as the primary or backup. This ensures that business operations continue to run smoothly while teething problems with the new system are resolved. There is also an opportunity to compare performances across systems.

However, unlike a full blown parallel strategy, the digital twin provides a bridge between old and new. This means that there is no need to run two exactly similar processes on two parallel systems. This addresses one of the strategy’s most serious drawbacks – cost and resources. No dual data entries also means fewer errors.

Instead the twin is able to make data available from one system to another, and rout transactions to one or the other, based on pre-determined business logic. Other functions can be integrated to the twin so that they are agnostic to either the new or old systems.

Once the new system has been proven to work at scale, and users become fully familiar with the new system, the bank can institute a full cutover from old to new. The use of a digital twin to augment parallel system adoption marks a turning point for banks desperately searching for a lower risk way to achieve digital transformation.