Navin Suri, Percipient’s CEO, was one of 30 entrepreneurs selected to take part in EY’s global 2018 Accelerating Entrepreneurs (AE) programme. The programme kicked off in Amsterdam last month, and was also attended by specially invited global thought leaders and corporate executives.

Navin welcomed the opportunity to be participate in the AE programme’s global ecosystem. He described the Amsterdam event as highly motivating and added, “EY’s decision to include Percipient helps to bolster the confidence of our early-stage investors. As we begin to leverage EY’s knowledge, market credibility and client access to deliver our capabilities faster and better, we expect the program to have significant positive impact on our growth too.”

Acquisitions, IPOs, big VC rounds – you name it and it’s beginning to happen in the ‘enterprise data integration’ space. The trend line is up, up and up. Here’s some recent all-round activity…

- Hitachi acquired Pentaho in 2015, $600Mn

- Talend listed on Nasdaq in 2016, $1.26Bn

- Mulesoft listed on NYSE in 2017, $2.9Bn

- Denodo did a big VC round from HGGC in 2017

- Synscort acquired by Centerbridge in 2017, $1.26Bn

- Mulesoft acquired by Salesforce in 2018, $6.5Bn

- Actian acquired by HCL & Sumeru in 2018, $330Mn…

The trend speaks for itself. One major transaction in 2015. One in 2016. Then three in 2017. And now two in just the first four months of 2018.

But the big question is WHY?

The answer is quite simple. All downstream enterprise applications – CRM, Mobile, Analytics, Bots, AI/ML, Visualising, Reporting, Dashboards, API stacks – are only as good as the data integration behind them. And enterprise data today is NOT integrated enough to power ALL these new apps. A 2015 Capgemini research report showed a staggering 79% enterprises had not completely integrated even their existing data sources.

Even a business as digitally-native as Salesforce cannot escape the user-adoption risk (or becoming collateral damage) from data silos that plague their clients. A survey of Salesforce users by Progress & Dimensional Research showed a massive 63% of responders stating that integration difficulties were resulting in slower Salesforce performance.

No surprise then that Salesforce bought Mulesoft for an eye-popping $6.5Bn. Marc Benioff, Chairman & CEO Salesforce said, “Now with Mulesoft, Salesforce will enable customers to connect all of the information throughout their enterprise across all public and private clouds and data sources – radically enhancing innovation.” Q.E.D.

Onerous vendor costs, licenses, data replication, inflexibility of off-the-shelf products and the tremendous enterprise effort required to integrate data are all to blame. Innovations, digitisations and disruptions all risk becoming victims, not because of a shortage of high-potential ideas, but of poorly integrated data behind those ideas.

So, what’s the prognosis for data users in the future?

Objectively speaking, it looks as exciting as it is sombre.

- While data from newer sources like IOTs, Speakers, Sensors is opening exciting new business possibilities, the true power of all that begins to only show up (or multiply) when integrated with older more traditional data. There is a basic need now to access old and new types of data, seamlessly. McKinsey estimate that connecting the physical and digital worlds could generate up to $11.1tn in economic value by 2025. Businesses like factories, transport, connected homes, hospitals, are already demanding quicker and cheaper data integration, just like banks have done the past 20 years.

- The growing adoption of cloud is creating a whole new data integration challenge. As enterprises start moving some data to the cloud, they are essentially splitting what limited data that may have been residing in one place. Business & Analytics teams face difficulties integrating new data sitting on cloud, with historical data and trends, sitting on-premises. As a result, cloud providers and analytics platforms now want to own a data integration platforms to offer their clients easier migration to Cloud.

- Businesses are also rapidly building data lakes, and understandably. They want to warehouse voluminous unstructured data. Estimates forecast that the data lake market will grow 350% in just the next four years. Businesses that plan to house new and/or old data inside a data lake will eventually still need to integrate that with enterprise data sitting elsewhere. OEMs & System Integrators offering data lake services would benefit tremendously by having in-house data integration platforms to propel enterprise adoption.

- AI/ML, or combining batch and streaming data are already the fastest growing category of use cases which enterprises across sectors are looking to on-board. Solution Providers in this space will carry a unique advantage (faster and smoother implementation), if they have their own data integration platform.

The advantages are indeed looking timely and logical and are a valuable strategic decision for any solution provider or consumer. In their paper titled ‘Breaking down data silos’, Harvard Business Review wrote “ Expect 80% of the work in becoming data-driven to be integrating your data…”.

The Salesforce COO Keith Block rightly pointed out on a call with analysts after the Mulesoft deal was announced that, “This is thinking about the next 10 years.”

We expect the trend of data integration platform acquisitions to continue to gain momentum at least for the foreseeable future.

And as more CEOs and company boards begin to put more data behind all they do, it would only be appropriate to reference Sherlock Holmes, the all-time master of the science of deduction. Decades ago, he lamented, “Data! Data! Data! I can’t make bricks without clay!”

Sherlock! We agree.

Navin Suri

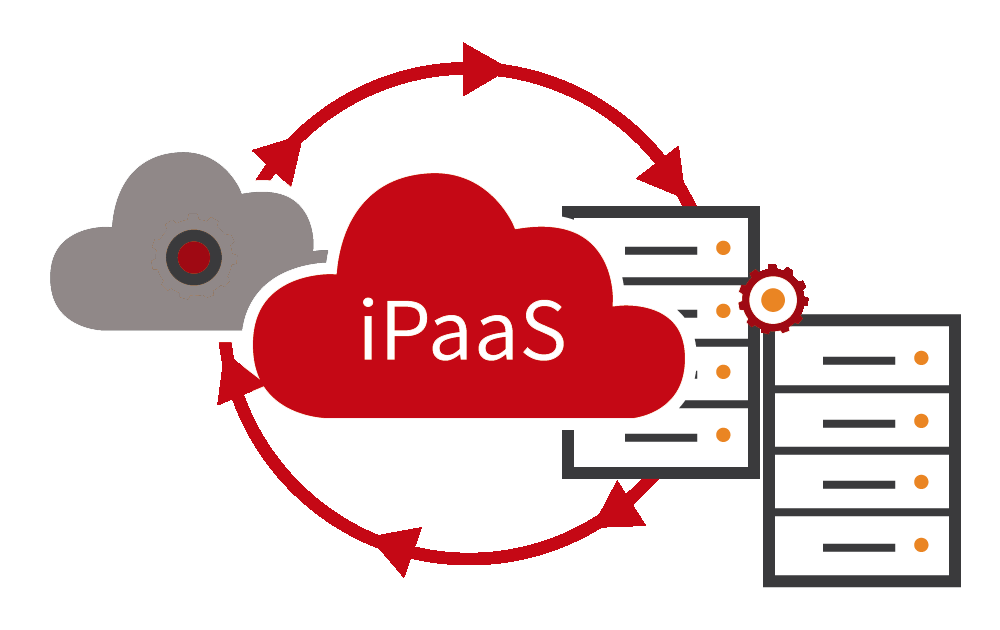

What is iPaaS and why are enterprises such big fans?

The inexorable shift from on-prem to cloud has given rise to a new breed of SaaS vendors. Gartner’s Enterprise Integration Platform as a Service 2018 report, published last month, suggests that subscription revenue in 2017 grew by an impressive 70%. At this rate, Gartner forecasts that the iPaaS method of delivering integration middleware will overtake and potentially consume the traditional model by 2021.

So what’s behind iPaaS’s popularity? Gartner defines iPaaS as “a suite of cloud services enabling development, execution and governance of integration flows connecting any combination of on premises and cloud-based processes, services, applications and data within individual or across multiple organizations.”

This definition brings to mind large and challenging integrations, but in fact,recent iPaaS growth has been driven by less complex needs. Enterprises’ growing adoption of cloud environments while retaining their legacy systems has resulted in strong uptake for “packaged integration”. Faced with a hybrid architecture in which data and applications are housed both on-prem and on-cloud, iPaaS offers four key benefits: seamless access, instant scalability, flexible pricing and easy upgrades.

Buoyed by this strongly growing market, Gartner notes that a clear divide has emerged between solutions that are aimed at large, strategic, enterprise-level transformations, and those that are application, use case or domain-specific, with a strong go-to-market objective.

Within these two buckets, iPaaS solutions can differ widely in their ease of deployment, ability to support existing on-premises tools, ability to support specific business use cases and API management. Enterprises therefore need to assess their needs carefully before choosing an iPaaS solution.

Another key consideration for enterprises is the potential of cloud provider lock-in. Cloud providers now tend to leverage on specific PaaS or SaaS solutions to distinguish themselves from their competitors, but enterprises may find integration middleware particularly difficult to unwind out of later. This is because iPaaS solutions tend to support, not one, but many applications. Enterprises should therefore assess not just the software but also the cloud provider, and opt for a cloud-agnostic solution where appropriate.

Percipient’s iPaaS solution, UniConnect 3.0, is set to be launched in June, 2018.