Digital Transformation Solutions Overview

Banking transformation agendas have changed since the pandemic. The days of temporary fixes are over but even plans to replace legacy banking systems are being reviewed.

This is because the leeway for transformation has shrunk dramatically. Banks hoping to implement digital capabilities over an extended time frame must now do so more quickly, for more customers, at higher transaction volumes, and with more features than previously anticipated.

Percipient’s ready-made solutions help address all of the above by enabling banks to:

- launch new digital applications while at the same time, migrating to digital systems

- test new applications intensively without disrupting existing services

- incorporate real time and analytics into all new digital applications

TWINN Digital Bridge

The risks associated with big bang core banking migrations are now considered unacceptably high. On the other hand, upgrading in stages to a new system can mean that customer information is increasingly siloed.

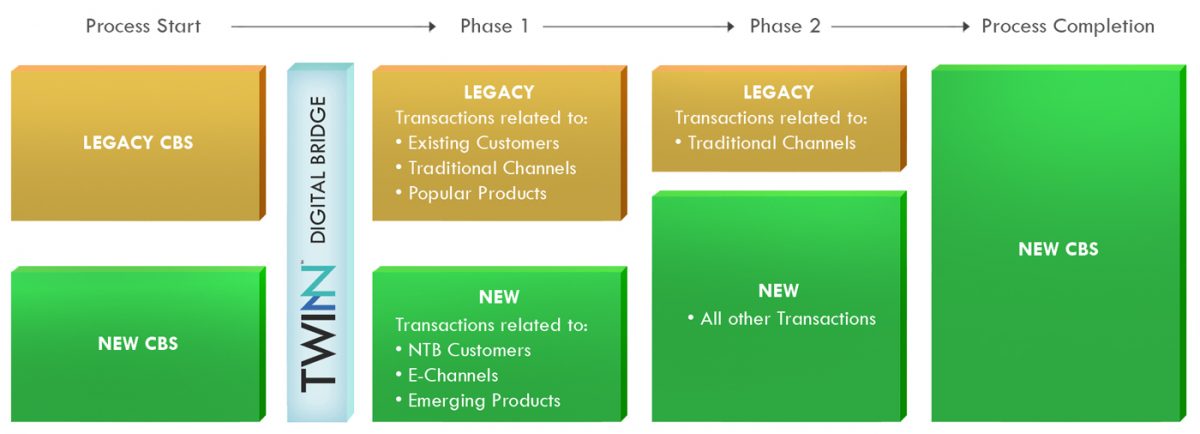

Example of a phased system migration

The TWINN Digital Bridge solution is designed to support progressive system upgrades by bringing together data from old and new systems into a single hub. This data is captured in real time, allowing transactions to occur as normal. Banks can decide to rout these transactions to either system, based on the customer segment, transaction channel, product type, etc.

Despite this routing process, data across both systems remains accessible and available for use as needed to enable existing services and new digital applications.

TWINN API Sandbox

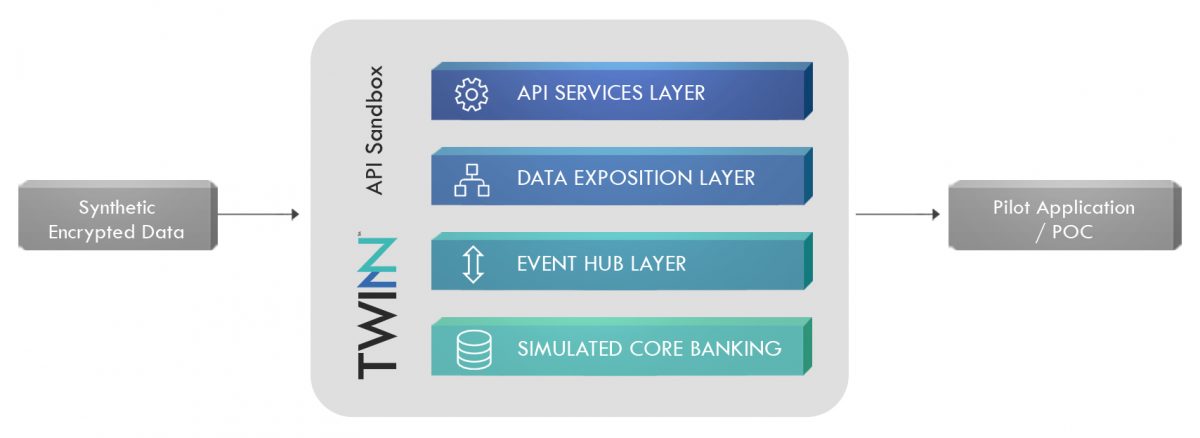

One of the biggest challenges for banks wanting to test new software is the reluctance to impact their core systems in any way. Instead, banks typically make do with downloaded static data. This leads to inadequate testing, especially in relation to performance at scale and data integrity.

The TWINN API Sandbox provides banks with the ability to test new capabilities using a cloud-based live transaction system that simulates a bank’s core processor. This solution comes complete with a set of banking APIs that are commonly used to enable retail banking customer journeys.

Banks have the option to use the Sandbox’s sample data or alternatively, they can upload their own encrypted data to the Sandbox. The ready-made APIs enables simulated create, read, update, delete (CRUD) transactions in real time without touching the bank’s backend systems.

TWINN Customer & Household 360

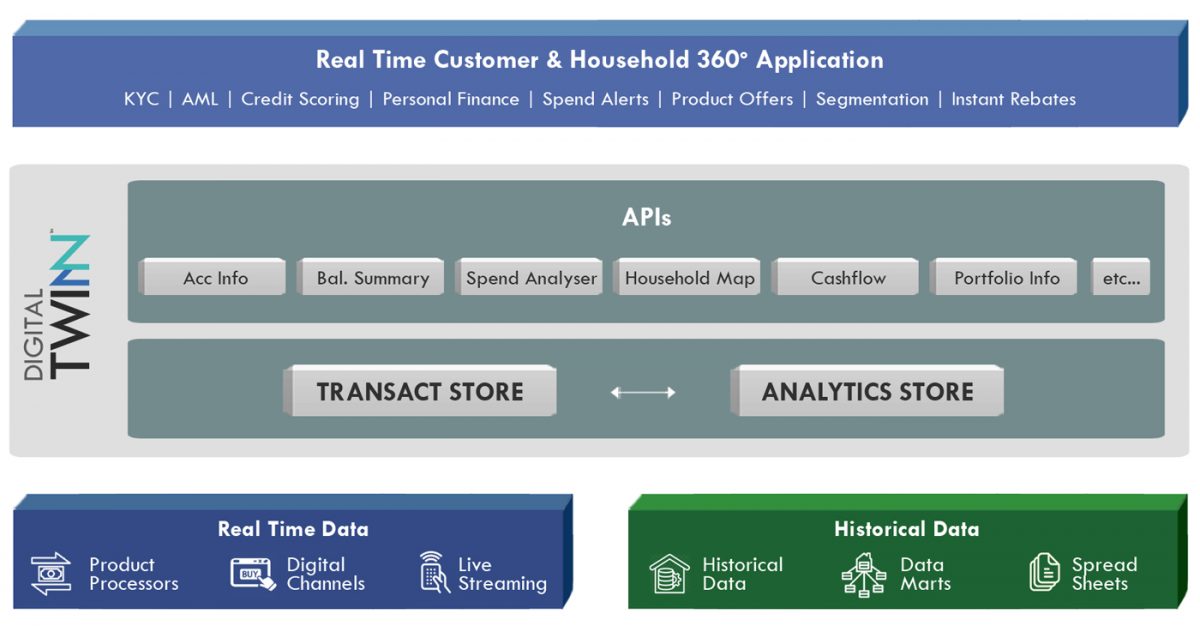

Despite advances in AI and ML over the past few years, the data needed to power these algorithms is not readily available.

Banks face a mountain of problems when there is a need to provide a single view of a customer and household regardless of their banking products, preferred channels, locations, merchant relationships, spending patterns, etc. The challenge is further exacerbated when advanced features are required, including real time analytics, data lineage, IoT and other unstructured data.

The TWINN’s ready-made set of Customer and Household 360 APIs seeks to help banks solve this in an accelerated way. These APIs can be used by the banks’ internal departments (eg risk, fincon, operations) or external partners (eg AI companies, e-commerce providers, agents) to create new hyper-personalised customer services or transaction monitoring in real time.

Copyright © 2020 Percipient Partners Pte. Ltd.

Percipient Partners Pte. Ltd.

80 Robinson Road, #09-04, 80RR, Singapore 068898