Overview

The Digital TWINN™ solution adopts a unique digital twin approach that is used by industrial companies and applies this to Financial Services companies.

But rather than simply creating a replica of a financial enterprise’s data, the Digital TWINN™ offers an augmented representation of this data, along with associated business processes, that is kept updated in real time using eventing technology.

This means that organisations can independently develop, test and deploy innovative applications, while retaining or incrementally upgrading existing infrastructure, without fear of disruption.

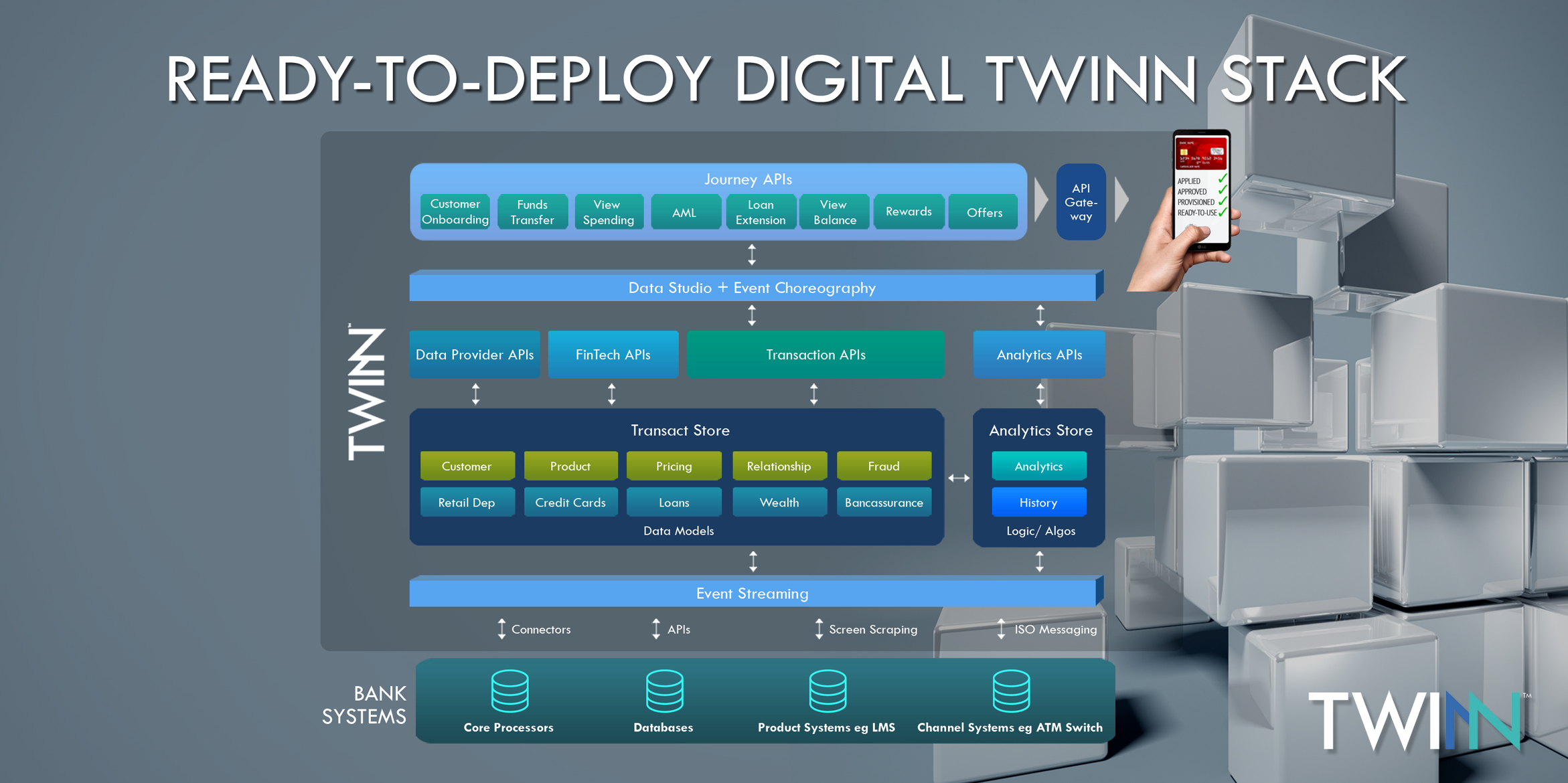

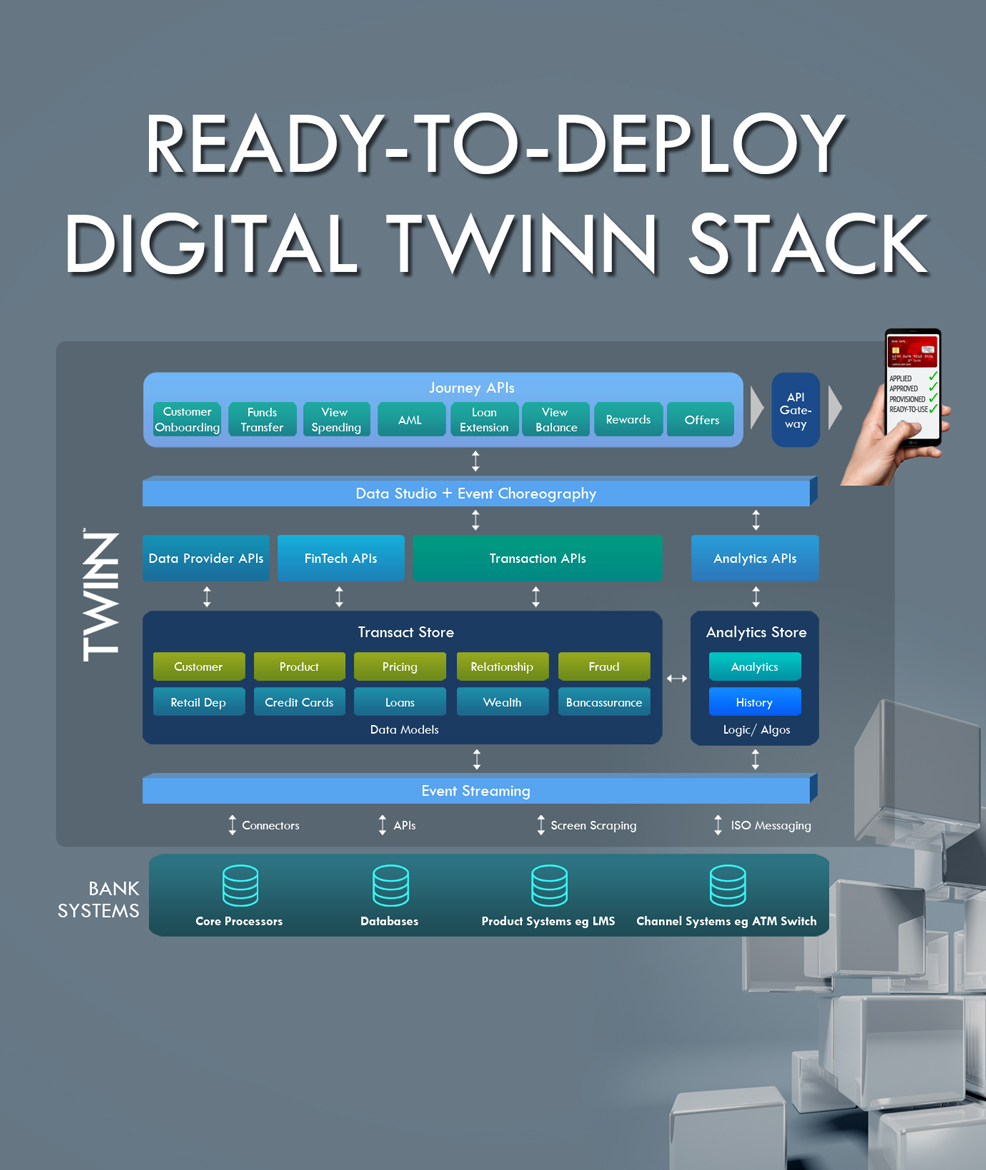

Architechure

Domain Components

Canonical Data Model

Enhanced metadata models maintained across traditional and new age data sources

Analytics APIs

A catalogue of single and cross-domain APIs to derive a range of real time analytics

Transaction APIs

A catalogue of domain-specific APIs that reflect granular level key business processes and logic

Customer Experience APIs

A mix of transaction and analytics APIs are expertly choreographed to deliver compelling customer journeys

Technical Components

Multimodal Data Stores

Carefully selected data storage technologies are synthesised to support different data structures

Analytics APIs

A catalogue of single and cross-domain APIs to derive a range of real time analytics

Event Hub

Real time capture, processing and routing of streaming data and change events

Data Studio

Self service platform for creating composite APIs to support customised digital journeys