Personalised Banking Services in Real Time: Isn’t It Time Banks Got Their Act Together?

Surprising as it is in this age of instant gratification, customer services that rely on real time analyses remain limited in scope, even among digital-first banks.

Take for example the fact that today for a majority of banks, these services are still not usually available in real time:

- First time account opening

- Personalised customer offers

- AML and fraud detection

- Transaction-based rewards

- Wealth portfolio positions

The persistence of two worlds

The reason is simple, even if the solution is not. Real time analytics rely on the coming together of transaction processing (commonly referred to as OLTP) and analytics processing (commonly referred to as OLAP). Yet these two sets of processes exist in separate technology worlds that do not intermingle easily.

This is particularly true in banks because here, OLTP teams are primarily focused on maintaining processing performance and data integrity of fast moving, mission-critical financial orders. The attention of the bank’s OLAP teams, on the other hand, is directed at ensuring the availability of large amounts of disparate data for complex data manipulation and reporting.

Having developed relatively independently over decades, these two worlds have spawned their own technologies and protocols. To bridge them requires data to be exported from one, transformed and imported to the other. This process takes time and effort, and is typically performed only at fixed intervals during the day, or overnight.

Personalisation is trending towards real time

It is only recently that, in the eyes of banking executives, the benefits of seamlessly integrating these two worlds have started to outweigh its risks, costs, and complexities. This aligns with other eCommerce marketers especially in light of the intense shift towards digital channels brought about by the Covid-19 pandemic.

For example, of the 400 eCommerce companies surveyed by Yieldify in July 2020 on what data was used to personalise their interactions with website users, 76% said they used real time behavioural data, 63% used cookie-based historical data, and 63% used data from other channels and platforms.

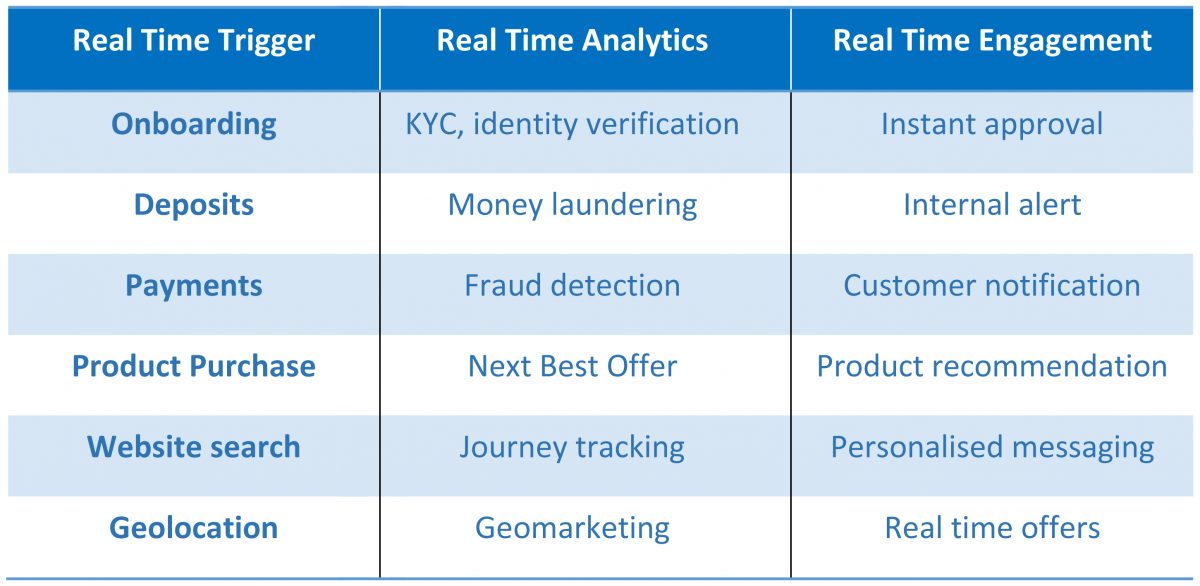

For banks, regardless whether customer interactions are taking place via mobile, online, branch, ATM, call centre or any other, real time analytics provides hitherto unavailable but highly valuable opportunities.

Banks can assess individuals’ immediate behaviour against their internal and/or external profiles in real time, and use the results to either instantly enhance a customer engagement or hold back a risky transaction.

Digital twins transcend the transaction/analytics divide

It is in this space of real time analytics that a digital twin really shines. The concept of a digital twin is to continually stream and replicate the data generated by a bank’s many systems and channels, and make this instantly available as APIs for any purpose.

By doing so, digital twins abstract an enterprise’s data from both its source and its eventual application. This means they in effect serve to collapse the OLTP and OLAP worlds into one. As the demand for real time customer personalisation grows, there are few more elegant ways to overcome the outdated rift between managing transactions, and putting transactions into context.