In this “do more with less” post-Covid world, banks will need more detailed datapoints to track their digital marketing ROIs

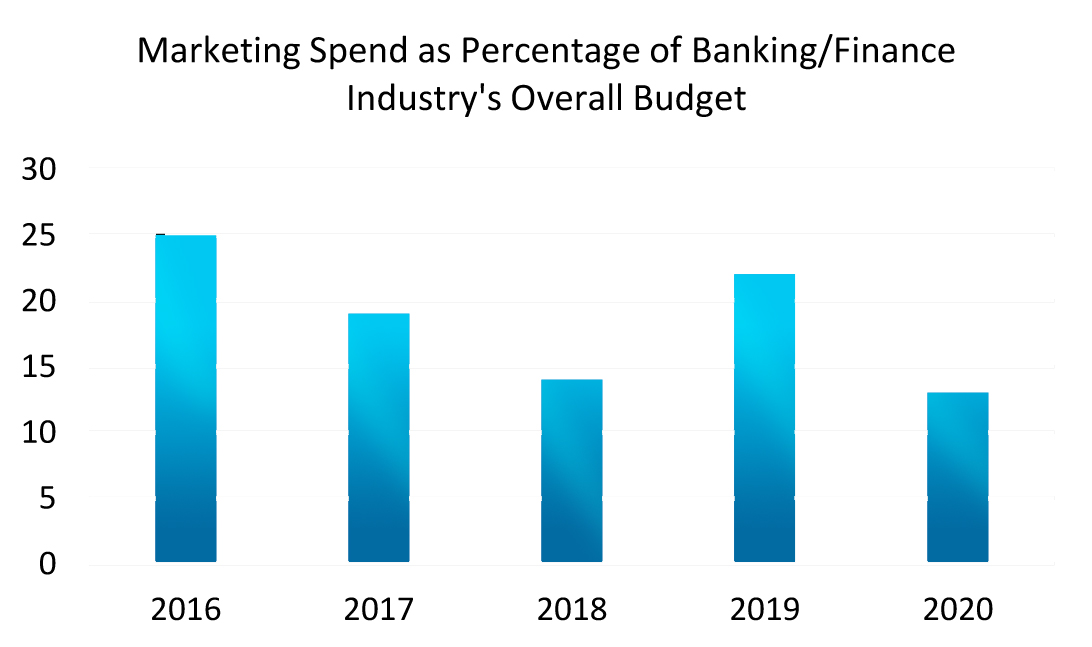

The Covid pandemic has had a variable impact on marketing budgets, with the US banking and finance industry seeing a particularly large decline. The CMO survey released in June 2020 showed that the industry’s marketing spend was 13% of its total budget. The same survey in August 2019 put the figure at 22%, one of the highest across all sectors.

Source: CMO

Source: CMO

But it isn’t just the big drop that is surprising, it is also that the larger cut (-11%) was to digital marketing versus non-digital marketing (-5%). To give an idea of how the banking industry diverged from other sectors, the retail sector for example actually increased its digital marketing budgets by 11%.

Part of the problem lies in the fact that banks just do not have the information they need to take the necessary digital marketing decisions. Banks lag in their digital marketing, but this is exacerbated by their inability to track how this digital marketing is experienced, thereby creating a vicious cycle.

The pandemic is making this problem even more acute. According to eMarketer, the pandemic is causing a shift among US banks towards performance marketing ie marketing based on achieving specific desired actions or outcomes. Traditionally, this has meant counting clicks, searches, downloads, bookings or sales.

But marketeers now agree that such superficial measurements do not provide sufficient insight into customer intent. Why is a particular customer outcome achieved, or not achieved? To understand this, marketing metrics is needed not just for the customer journey but also his micro-journey. In the drive to optimize marketing dollars, the smallest incentive and friction point needs to be identified across every digital channel.

Source: Digital Banking Report Sept 2020, The Financial Brand

Source: Digital Banking Report Sept 2020, The Financial Brand

Yet the biggest problem that banks’ marketing teams face today is that while such data is collected, it remains hard to access and interpret. The Financial Brand’s recent survey of financial marketeers verifies this. When asked to identify their major challenges, far more financial marketeers cited data analytics, data accessibility and performance measurement than those lamenting budget constraints.

It is perhaps not surprising therefore that Forrester report an uptick in replatforming enquiries since the Covid outbreak. They put this down to the desire to lower cost, but surveys such as the one above suggest a corresponding desire – for those on the marketing front line to be able to pick apart customers’ Covid-intensified digital interactions.

New-age, microservices-based digital integration platforms such the TWINN aim to do both. Traditional martech stacks consist of a complex web of databases, CRM systems, automation and notification systems, content management systems, social media management systems analytics and attribution systems, the list goes on. New age platforms give banks the option to sunset some of these components while gaining greater connectivity across data sources, thereby achieving previously unattainable marketing datasets and analytics.