It is no surprise to me that Southeast Asians love their mobile phones. But what is surprising is how much! According to a 2018 report, Southeast Asians’ 141% mobile connectivity rate is among the highest in the world, beating hands down the North Americans (103%), Western Europeans (119%) and even their East Asian cousins (103%).

Within the region, Cambodians lead the pack with a mobile penetration rate of 181%. This number suggests that nearly every Cambodian owns two mobile phones! In reality, penetration rates are much higher among urbanites, but even in rural areas, penetration has increased by 20% in the last two years alone.

While nowhere close to this pace of growth, the number of banked Cambodians has also grown. About 4% of the population had a bank account back in 2011, compared to about a quarter of the population today. This is still a low number relative to other markets, but in the current digital age, I would argue that account ownership may be becoming a less relevant measure of financial inclusion. Rather, according to the country’s financial regulator, 71% of Cambodians now have access to financial services.

I credit Cambodian fintechs and digital banks for much of this trend. Similar to other developing markets, digibank Wing Cambodia gained a place in the hearts and wallets of Cambodian society by offering town dwellers an easy and low-cost way to transfer money to their families living in the countryside.

Importantly, Wing offers the mechanism of a one-time code for such transfers. This requires users to download their app, but without the need to formally open a bank account. Similarly, local fintech Pi Pay’s app uses QR code technology to facilitate cashless payments, without a bank signup. In nine months, the company has seen 160,000 downloads of its app.

These innovations sidestep FIs’ standard onboarding processes. But the data generated provide invaluable insight into the user, including identity verification and creditworthiness, which then serve as a conduit for other financial services. Mainstream banks have yet to embrace the concept, but notably, smaller player PPC Bank is testing the waters with a non-account mobile phone transfer service.

Today, technological developments mean markets like Cambodia have an opportunity to build financial inclusivity without financial bureaucracy. Advances in data technology allow FIs to offer high quality, personalized services to low income individuals without sacrificing on KYC standards and other regulatory protections. There is really no excuse for even the poorest rural communities to be excluded from basic financial services.

Navin Suri

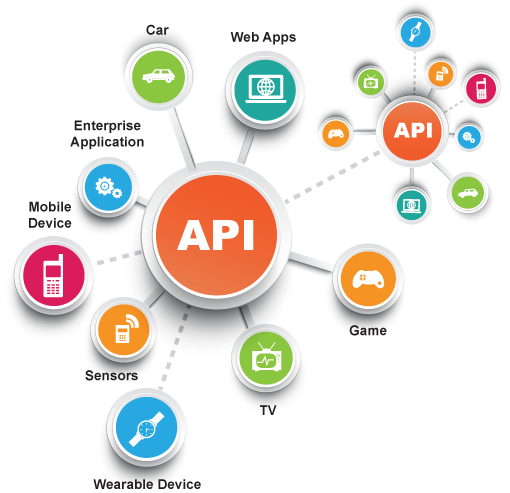

What are APIs and how do they help unlock data from backend systems?

Banks want to keep launching cutting edge mobile applications, but don’t want these to undermine their backend systems. The simple answer is to build APIs.

APIs are protocols that make it easy for front and back end software components to interact with each other. Although in existence for a long time, the broad availability of APIs has revolutionised the way digital applications are built. No longer a long, laborious process, APIs enable sophisticated customer apps to be fashioned, constructed, tested and productionised in weeks rather than months.

So it goes without saying that API use in banking makes good consumer and business sense. But despite these innovations, and banks’ unparalleled store of customer data, financial services account for only 5% of the API-led business platforms globally. Even amid regulatory support for Open Banking initiatives around the world, banks continue to worry about the effect of APIs on the performance, security and reliability of their backend systems.

In fact, the reverse is true. APIs reduce the impact on banking systems compared to traditional technologies. Here’s how:

- Resource-lite: APIs allow much of the inquiry traffic to a backend system to be offloaded elsewhere. This means backend systems have less to do, and are barely hit where near-static information is extracted in batches. In some cases, previous day snapshot inquiries can be supported without any dependency on backend systems. This can also dramatically reduce the use of expensive technology resources.

- Change simplification: One of the greatest challenges banks face today is the rapid change in data formats resulting from the need to launch new or enhanced customer applications at regular intervals. With APIs, such process complexities are abstracted from bank systems. As long as the data requirements are supported in existing APIs, such format changes do not require a change in banks’ systems.

- Raw Data Processing: A lot of the tedious effort of the mapping, translation and parsing of raw data can be delegated to the API build process. As a result, capacity requirements for maintaining transaction systems can be significantly reduced. This becomes even more important when data volumes increase exponentially, as you would expect from multiple apps.

- Support for Business Processes: Data across multiple sources must be transformed to ensure alignment with a bank’s business processes and business logic. But these processes evolve, requiring data transformations to be updated regularly. By appropriately orchestrating a relevant set of APIs, the need to impact backend systems can be minimized.

- Cost Elasticity: In traditional platforms, hardware across web servers, application servers and backend systems must be manually added if additional resources are required. Many APIs can instead be auto scaled to handle increased or decreased demand. Only the backend resourcing needs to be adjusted. In a typical scenario, this accounts for about 50% of the costs. The other half related to volume fluctuations can be reduced significantly.

Online banks are here to stay and with them are a plethora of mobile banking apps that are available for free for personal credit lines, credit and debit cards, currency exchange services, cross border transactions, savings accounts, mortgages and much more. As traditional banks seek to catch up with their digitally-native challengers, APIs look set to become the cornerstone of modern banking.